Executive Summary

Evaluation of the current situation

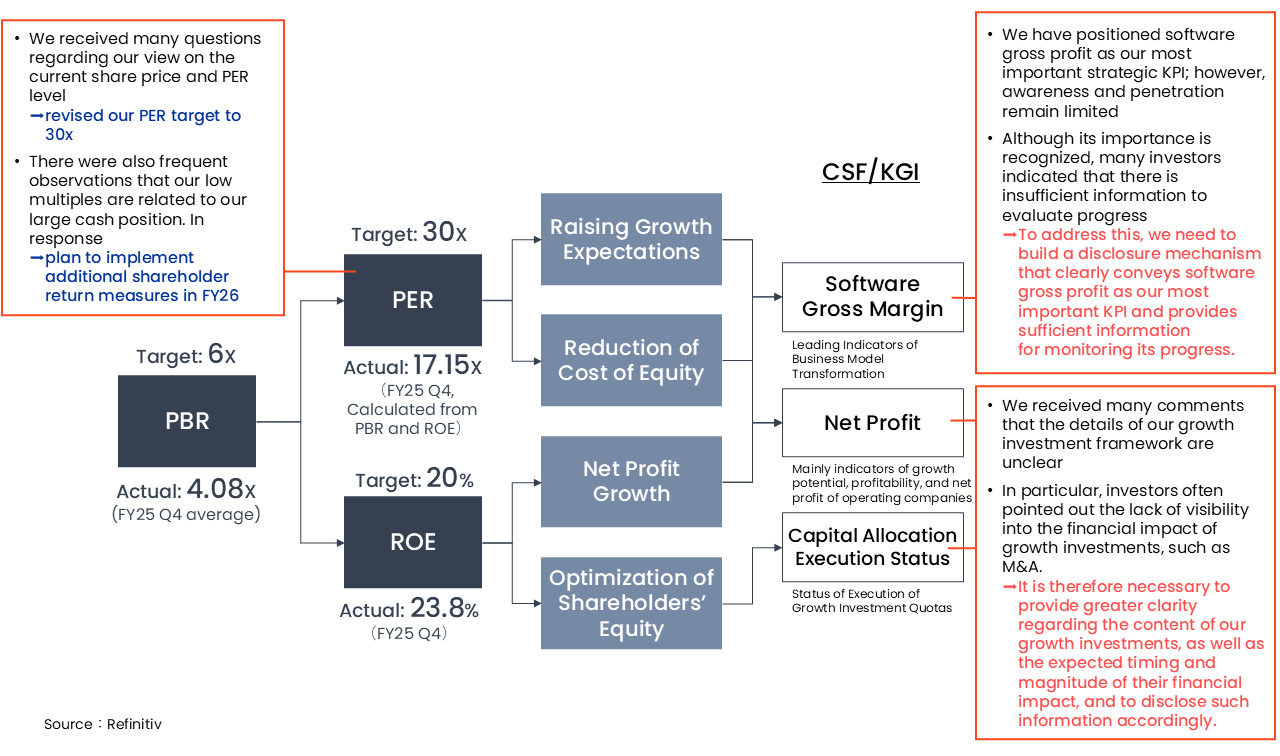

- Compared to the target PBR of 8x and its components, P/E ratio of 40x and ROE of 20%, the P/E ratio is below 20x, creating a gap with the target. We believe that the P/E ratio of 40 times, even when compared to domestic software companies, needs to be revised

- ROE has been around 20% against our assumed range of cost of equity (4-11%), and the equity spread has been generated sufficiently

Policy and Targets

- The medium-term plan "BE GLOBAL 2028" aims for a 3x net income growth rate and an average growth rate of 25%. Aim for PBR of 6 times, PER of 30 times, and ROE of 20% as a discipline by realizing a business model transformation that promotes higher growth expectations and lower cost of capital, with software gross profit as the driver

- We plan to invest ¥20 billion in growth to realize our strategy, and will optimize the level of shareholders' equity through capital allocation optimization

Initiatives and implementation schedule

- Through creative dialogue with investors, we will recognize areas where disclosure is insufficient and work to improve disclosure going forward

- With the aim of strengthening the overall momentum of the value-creation spiral—by expanding to all employees a structure that enables them to benefit from the results of the spiral from human capital value creation to corporate value creation—we introduced equity compensation tailored to employees, Group Executive Officers, and Group Directors starting in FY2024. Specifically, equity compensation was newly introduced for employees from FY2024, the schemes for Group Executive Officers and Group Directors were revised, and for Group Directors, the scheme will be shifted to restricted stock from FY2025

Evaluation of the current situation

The target for corporate value is a P/B ratio of 8, but there is currently a significant gap with the target P/E ratio of 40

Although not reaching the target PBR of 8x, the PBR has been in the range of 3-5x

Although the multiple was at the 25x level at times during FY25, it is below 20x on average, and there is a large deviation from the target of 40x

The ratio exceeds the 20% target level as a discipline

Insights from a comparison with domestic software companies

- Considering the level of the sales growth rate and the operating margin, the Group's valuation is expected to be at a PER of around 20 times, but is currently below the level

- Achieving a P/E ratio of 40x is assumed to require fundamentals that bring the sum of the sales growth rate and the operating margin to the 60-70% level

EPS growth does not seem to be fully reflected in the market value of business assets, which may be partly attributable to the company’s high level of cash holdings

- While the cost of equity calculated using CAPM (risk-free rate + β × equity risk premium) has declined, the current β level is as low as 0.44, showing a significant divergence from overall market movements

- Therefore, we considered it necessary to apply a size premium adjustment, and, referring to Ibbotson data, added a 3.1% premium to calculate the cost of equity (risk-free rate + β × equity risk premium + size premium)

The equity spread has remained positive when comparing ROE with either the cost of equity calculated using CAPM or the cost of equity adjusted by a 3.1% size premium

Policy and Targets

We have set financial targets of doubling revenue and tripling profit, with a strategic KPI of tripling software gross profit to ¥6.0 billion

By concentrating on software gross profit and evolving our software into a market leader in corporate value management, we aim to build a business that combines stable growth with high profitability

With respect to ROE, we have already achieved our target level. The current challenge is to raise our PER. Considering the current valuation level and the fundamental levels implied by comparisons with domestic software companies, it is appropriate to revise our PER target to 30x

Improvement of ROE (return on equity)

Improvement of PER (Price-to-Earnings Ratio)

- Increase shareholder returns as a means of temporarily reducing net assets

- Consider borrowing as necessary to secure investment for growth

Initiatives and implementation schedule

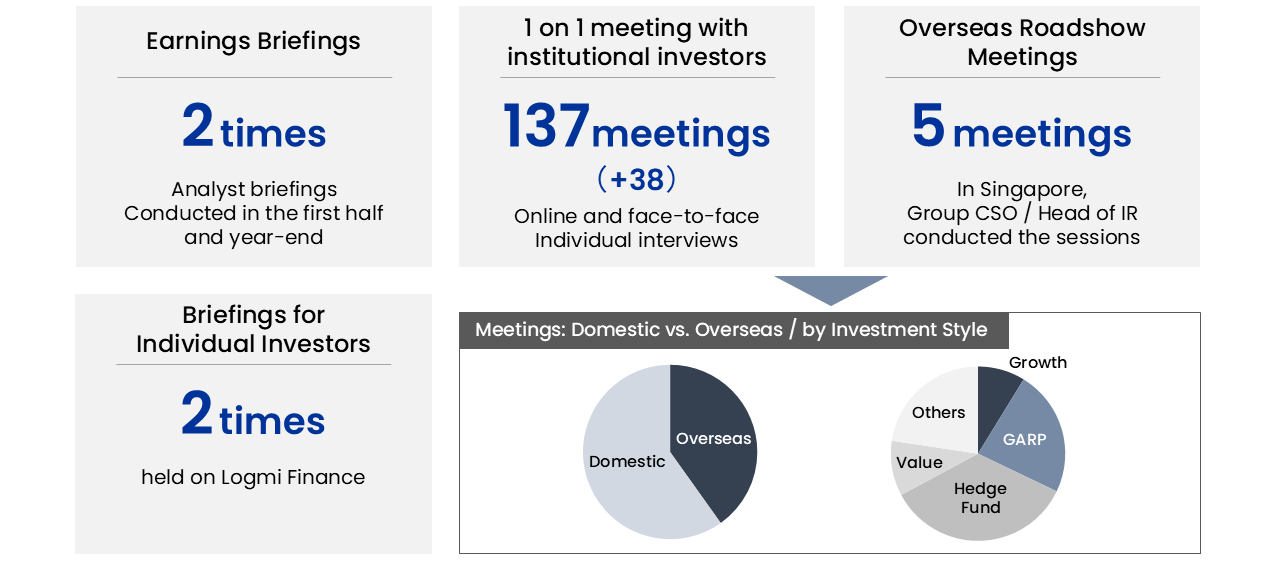

Our IR initiatives targeted institutional investors, aiming to facilitate constructive and value-oriented dialogue

Through dialogue with investors, the key issues have been clarified, and responses are required

Strengthen the momentum of the entire value creation spiral by extending the structure that allows all employees to enjoy the results of the spiral from human resource value creation to corporate value creation

Provide stock compensation to all layers to raise awareness of corporate value improvement